|

Auto insurers are finally starting to make peace with rideshare drivers.

In case you have been tucked away in the suburbs, rideshare drivers are everyday people who use apps run from companies such as Uber, Lyft and Sidecar to turn their personal cars into taxis of sorts.

Ridesharing -- sometimes called "ride-hailing" -- has been growing at an impressive clip. Uber, the largest service, recently reported it had more than 162,000 active drivers out on U.S. roads.

As drivers embrace the chance to earn extra money hauling strangers around, insurance companies have balked about the risk. Drivers need traditional types of car insurance -- especially liability -- to cover their personal use, and ridesharing companies typically offer coverage that kicks in when a paying passenger is in the car.

In between, though, there’s been a huge gray area: the period when a driver is available for fares but does not yet have a passenger.

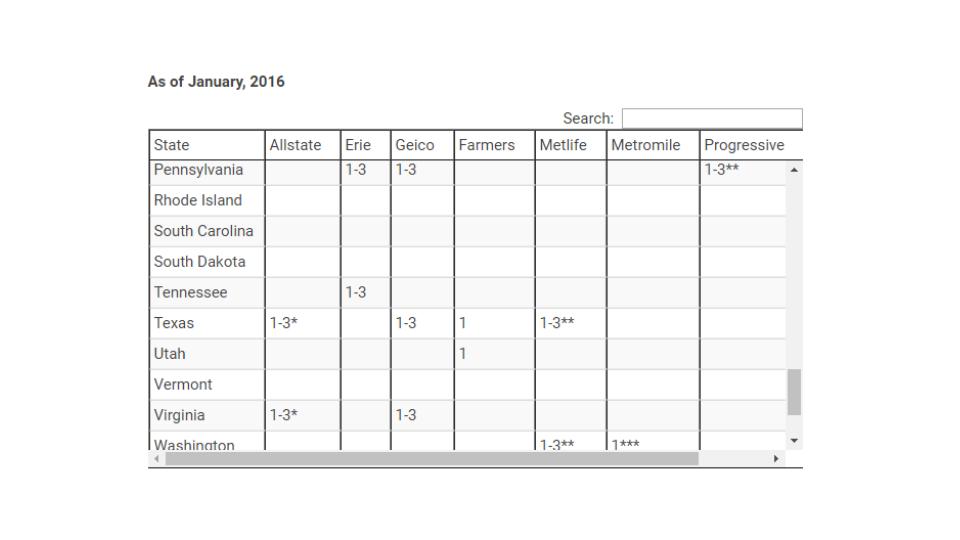

The good news, for drivers in some states at least, is that major insurance companies are at last offering options that deal with “transportation network companies,” TNCs, as regulations now label them -- and they appear to be quite a bit less costly than a full-blown commercial policy would be.

When is a taxi not a taxi?

When Uber X launched, it put a commercial policy in place that provided $1 million of liability coverage per incident for their drivers. Lyft offered similar coverage.

The rub is that these policies were only in force from the time a driver accepted a trip from Uber’s app till the driver dropped the passenger off, referred to as Period 2 in the rideshare business.

This leaves the driver, or more accurately, the driver’s personal insurance policy, on the hook when the app is on and the driver is seeking riders, referred to as Period 1.

Unfortunately for rideshare drivers, every personal auto insurance policy ever written specifically excludes coverage if the driver is engaged in commercial activities such as pizza delivery, or say, acting as a taxi.

This led to a lot of lies to insurance companies by rideshare drivers, not to mention denied claims. Even if an insurer decided to cover a rideshare claim, the driver often received a cancellation notice in the mail shortly after the check cleared.

Car insurance for teens is already expensive; for many, the cost of a commercial policy was prohibitive.

“Commercial policies are more expensive than personal auto insurance for a reason,” says Des Toups, managing editor of Insurance.com. “An injured person might press harder for damages if there is a perception that the driver was working for a multibillion-dollar company at the time – even if that isn’t exactly the case for Period 1 drivers who are seeking a fare but don’t have a passenger on board yet.”

A commercial policy that includes livery coverage -- and its much higher liability limits -- typically costs $5,000 to $8,000 depending on location. It can easily cost more.

The 'app-on, app-off' dilemma

That “insurance gap” became a huge issue in late 2013 when an Uber driver hit and killed a 6-year-old girl in San Francisco.

Uber quickly absolved itself of liability because the driver didn’t have a passenger in the car. The driver had $30,000 in bodily injury liability on his personal policy – the California state minimum, nowhere near enough personal coverage to handle the damages. The family sued both Uber and the driver.

Uber and the family eventually reached a confidential settlement, but not before provoking discussions that are now helping to define requirements for these not-quite-taxis.

Several states have now passed laws outlining rules for “transportation network companies” covering background checks, training and insurance requirements. That’s allowed a raft of insurance companies to step in with hybrid policies that straddle personal and commercial use.

In addition, Uber added Period 1 liability coverage in March 2014. Unfortunately, the coverage is contingent in most states, meaning a driver must file a claim with his or her insurer first (and risk cancellation) before Uber’s coverage will kick in. Lyft offers a similar contingent plan.

According to www.insurance.com, Erie Insurance is the only company in Tennessee to cover ridesharing policies.

Posted Thursday, April 28 2016 11:17 AM

Tags : uber, lyft, ridesharing, taxi, insurance, auto insurance, coverage, safety, precautions

|